Article written by Cezar Petrescu

Partial Results

*The data is in real-time, with the source for composing this report being prezenta.roaep.ro.

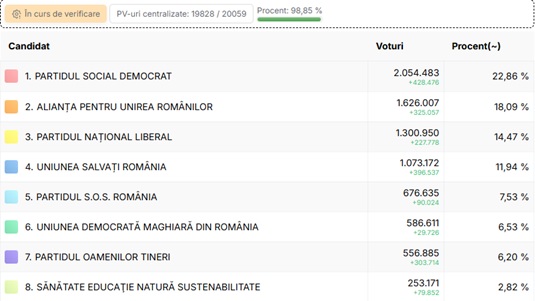

After centralizing 99% of the ballots at the national level and 90% of the ballots from polling stations abroad, the PSD Party is the new winner of the parliamentary elections on December the 1st, recording approximately 23% of the total votes, according to official real-time data. They are followed by AUR with 18%, PNL with 14.55%, USR with 11.86%, SOS with 7.43%, UDMR with 6.58%, and the Young People’s Party (POT) with 6.12%. In the category of parties that did not meet the electoral threshold required to enter Parliament, we find SENS (2.8%), Forța Dreptei (1.94%), REPER (1.34%), and DREPT (1.20%).

*We point out that there are no major differences between the votes agreed for the Senate and the Chamber of Deputies.

Votes lost to sovereignists

Traditional parties have begun to rapidly lose ground to sovereigntist parties, which have seen a substantial increase in popularity in recent months. The percentages recorded on December 1 confirm this trend. Compared to the last parliamentary elections held in 2020, the parliamentary party that has experienced the most significant growth in votes is George Simion’s AUR, which at that time secured approximately 9% of the total votes, causing a significant shock in public opinion. Now, there is a very high chance that George Simion’s party will double its 2020 score of 9%, recording 18% at the time of writing this report.

We observe that sovereigntists have succeeded in gaining votes from traditional parties, which have profoundly disappointed the electorate over the past four years. Drawing a parallel, compared to the results from 2020, the main traditional parties that have lost the most votes are PNL (25% of votes in 2020 vs. approximately 14% in 2024), followed by PSD (29% of votes in 2020 vs. approximately 22% in 2024) and USR (15% of votes in 2020 vs. approximately 11% in 2024).

Most of these votes have now shifted to sovereigntist and extremist formations such as SOS, POT, and especially AUR, particularly when it comes to voters who previously supported PSD or PNL. On the other hand, traditional USR voters have also turned to progressive parties such as SENS or REPER—both political formations that split from USR but have so far failed to meet the electoral threshold. The results of the parliamentary elections on December 1 indicate that the future Romanian Parliament could successfully achieve a future pro-European parliamentary majority. The pro-European parties that surpassed the 5% threshold—namely PSD, PNL, USR, and UDMR—could form a comfortable majority of over 55%, to which the minority groups could also be added.

Even so, nothing is yet decided. Statements in the political sphere following last night’s elections show that PNL and PSD seem to be waiting with interest for the second round of the presidential elections on December 8, given the significant role the President of Romania plays in appointing the Prime Minister. However, we can play a bit with our imagination and speculate on how the future Government of Romania might look. We have not included here a hypothetical scenario where PSD forms a political alliance with AUR, SOS, and POT, as such an approach could cause too much consternation across society.

What will the future government look like?

The results of the parliamentary elections on December the 1st indicate that the Romanian Parliament could successfully achieve a future pro-European parliamentary majority. The pro-European parties that surpassed the 5% threshold—namely PSD, PNL, USR, and UDMR—could form a comfortable majority of over 55%, to which the minority groups could also be added.

Even so, nothing is yet decided. Statements in the political sphere following last night’s elections show that PNL and PSD seem to be waiting with interest for the second round of the presidential elections on December 8, given the significant role the President of Romania plays in appointing the Prime Minister.

However, we can play a bit with our imagination and speculate on how the future Government of Romania might look. We have not included here a hypothetical scenario where PSD forms a political alliance with AUR, SOS, and POT, as such an approach could cause too much consternation across society.

Possibility No. 1:

A potential victory for Călin Georgescu in next Sunday’s presidential elections could lead to the formation of a PSD-AUR-PNL governing coalition, creating a majority of over 55%, even without UDMR. In this scenario, USR and UDMR would be excluded from government. This setup might result in the appointment of George Simion as Prime Minister, a scenario likely to receive parliamentary support from POT and SOS—two small political formations maintaining a nationalist and sovereigntist agenda. The opposition, comprising USR and UDMR, would be relatively weak and unable to effectively challenge such a coalition.

Possibility No. 2:

Călin Georgescu’s election could send shockwaves through the Romanian political system, prompting PSD, USR, PNL, and UDMR to form a pro-European governing coalition to counterbalance the Eurosceptic vision of a potential President Georgescu. This coalition would act as a “cordon sanitaire” around the sovereigntists in Parliament, who currently hold approximately 32% of the total votes. This new reality signals a warning for pro-European parties, given that over a quarter of Romania’s Parliament is composed of sovereigntists and nationalists.

Appointing a new Prime Minister in this scenario could prove challenging, particularly as Parliament would likely press for the President’s nominee to come from the pro-European coalition. Without successful negotiations, this situation could lead to a political crisis, akin to Belgium’s prolonged period without a fully functioning government.

Possibility No. 3:

Elena Lasconi’s election as President could secure USR’s participation in governance, within a coalition of PSD-USR-PNL (possibly also including UDMR). The future government would be led, according to Lasconi’s statements, by PNL leader Ilie Bolojan, with ministries distributed among the coalition parties. This arrangement could prevent a political crisis that might block the appointment of a Prime Minister, ensuring the continuation of Romania’s European trajectory.

Party positioning towards the business environment. Key facts.

USR

- a freer economic environment, emphasizing a lower-taxed economy and advocating the idea that “work should be encouraged, not taxed.”;

- tax reductions on salaries, independent activities, and SMEs;

- reverting to the previous taxation system for microenterprises and independent activities, reducing the contribution to the Health Insurance Fund (CASS) and the Social Insurance Fund (CAS) to 12 minimum wages;

- reducing the tax rate for microenterprises to 1% of sales up to 500,000 euros;

- removing the restriction that one person can own only one microenterprise;

- regarding VAT, USR suggests collecting it only from the final company that sells to the end consumer;

- boosting research, tax incentives for companies investing in research and development in emerging fields;

- expanding professional counselling services.

AUR

- to ensure at least 10 years of stability in fiscal legislation, which will be legislated within the first six months of governance;

- a 2% turnover tax for companies with a turnover under 5 million EUR;

- 16% profit tax for companies with a turnover exceeding 5 million EUR;

- companies with a turnover exceeding 50 million EUR, the profit tax will be 16%, but no less than 1% of the turnover;

- a “drastic reduction” in contributions to pensions, social insurance, and health;

- increase in the minimum gross salary without changing direct fiscal contributions;

- limiting fiscal institution controls to one inspection per year for each business;

- reindustrialization, domestic production, and leveraging Romania’s natural resources and strategic companies,

- significant deregulation to ease market entry, mandatory listing for large companies, and utilizing the capital market to secure financing;

- benefits for key industries like petrochemical, steel, and construction materials, along with a temporary export ban on certain resources and a mandate for domestic raw material processing;

- a requirement for retailers to stock at least one Romanian product where available;

- a Sovereign Investment Fund.

PSD

- a predictable tax system that emphasizes stability in taxes and fees;

- the income tax will remain at 10%;

- the corporate tax will remain at 16%;

- the general VAT rate will remain at 19%;

- the reduced VAT rate for certain goods and services, as well as property taxes, will remain unchanged;

- any changes to taxes and duties will be discussed in advance with the business sector;

- fiscal and budgetary consolidation over the next seven years, in line with its fiscal plan submitted to the European Commission;

- a more flexible interpretation of European fiscal rules, advocating for certain state expenses to be treated separately;

- reduce labor taxation and stabilize prices for essential goods;

- reindustrializing Romania through economic patriotism and supporting domestic production;

- Romania as a technological and industrial hub by investing in high-tech industries, defense, and a circular economy for metals;

- EUR 200 million for Romanian firms involved in Ukraine’s reconstruction;

- lobbying for continued cohesion funds for large enterprises post-2027 and extending Recovery and Resilience Mechanism

- expanding dual and technical education programs, modernizing vocational schools,

- targeting high-unemployment areas with grants and subsidized loans;

PNL

- maintaining the flat tax rate to support private investments;

- maintaining the 500,000 EUR taxation threshold for eligible micro-enterprises, with a 1% tax rate;

- the distribution of dividends as shares to incentivize employees;

- improving citizens’ living standards through increased productivity across the entire economy;

- strengthening financial discipline through institutional reorganization of fiscal bodies;

- objective and transparent selection criteria for audits, limiting repeated fiscal audits during the five-year statute of limitations, and enhancing transparency in tax administration;

- a growth market for SMEs on the Bucharest Stock Exchange;

- state aid for sectors like steel, petrochemicals, manufacturing and natural resources processing;

- Small manufacturers would receive technical assistance to adopt sustainable practices;

- 1% of GDP to research.

What to expect next?

For now, Marcel Ciolacu has declared that the government he leads will remain in place until the new Parliament negotiates a majority capable of granting a vote of confidence to the new Prime Minister proposed by Romania’s new president. As we know, the President of Romania is responsible for appointing the Prime Minister after the parliamentary elections, following consultations with the parliamentary parties that won the elections or a coalition of parties that has secured a majority in the newly elected Parliament. The Prime Minister appointed by the President, as a result of these negotiations with parliamentary political parties, must request a vote of confidence from Parliament within 10 days of their designation. This request involves presenting the proposed cabinet of ministers and the governing program to the Legislature.

The joint plenary session of Parliament (Senate and Chamber of Deputies) debates the list of proposed ministers and the governing program of the Prime Minister designated by the President of Romania, then decides whether to grant or reject the vote of confidence. If Parliament does not grant a vote of confidence for the government’s formation within 60 days from the first request, and only after rejecting at least two such proposals from the President, the President, after consulting the presidents of the two Chambers and the leaders of parliamentary groups, may dissolve Parliament. Parliament can only be dissolved once within a year.

Why can’t we speak of a clear timeline yet?

At the time of writing this report, the Constitutional Court of Romania (CCR) has not yet issued a decision on the recount of votes from the first round of the presidential elections. There is a possibility, albeit a small one, that the CCR might decide to cancel the first round of the presidential elections. Such a decision would “shake up” the entire political scene and will push the elections to December 14 and 28, disrupting the entire government appointment calendar.

At Issue Monitoring, we provide real-time alerts and detailed insights to help you navigate these changes effectively. If you’d like to learn more about how our platform can support your work, feel free to connect! 🤝